The good news for the East Bay housing market is that prices are holding and 2017 looks to be a great year ahead. Currently, there is very little inventory available across the region, which seasonally occurs. As you may be aware, the Federal Reserve raised the interest rates again and hinted at two more increases in 2017. This could have an impact on the market, as more buyer’s consider getting into the market to take advantage of a fixed rate mortgage to hedge against future rate increases.

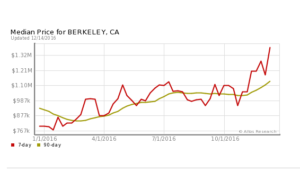

According to Altos Research, which tracks real time data, inventory in Berkeley has been falling steadily since October and now is hovering around 50 available properties on the market. In Oakland, inventory is also dropping with 343 properties available while days on the market is rising.

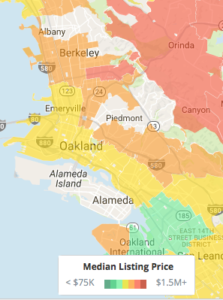

The median price for a home in Berkeley is $1.2 million, which has been rising steadily since last January. In Oakland, the median price is $603,000, a $40,000 average drop since it’s high in October.

Interesting to note in Oakland, a four bedroom home has risen by 10.7% year over year to $935k, but the price of a three bedroom home has dropped 1.9% to $660k. Whereas in Berkeley, a three bedroom home has jumped 22.7% year over year to $1.2 million and the price of a four bedroom home has increased slightly by 6.3% to $1.45 million. In nearby Albany, a four bedroom home jumped by 154% year over year to $1.85 million. (Since Albany is a small city, a large home sale could skew the statistics. There is currently only four homes on the market there.)

In El Cerrito, where the median price of a home is $886,400, the median price has been rising steadily since April with a peak of $900k in November. There are currently about 21 homes on the market.

As we head into 2017, we foresee an increase in interest rates which will motivate buyers to purchase before the rates go up further. It is likely that this will effect the lower tier of the market more than the upper tier. We see continued competition for buyers in homes under one million with an expectation that competitive offers will drive prices up another 3 – 5%. The market for homes over two million, however, may continue to slow due to perceived difficulty in accessing home equity for a move-up purchase, and due to a slowing of foreign investment. The upper market may experience prolonged marketing periods and softening sales.

Happy Holidays and if you are in the market for a home, contact us and we can ensure you are ready to go when sellers start to put their homes on the market in January. And sellers, if you are ready to list, we can help you get ready for a strong buyer’s market in early 2017!

Comments