The hot 2017 spring market is starting to see some cooling in the upper echelons of price in some East Bay cities and according to real time data provider, Altos Research, a slight rise in days on the market for both Oakland and Berkeley and a rise in inventory for the market overall.

Looking at the Trulia Trends report for Berkeley, there is a clear demarcation of the activity in home sales priced below $1.2 million, the median price for a home in that city. The market is still moving quickly in that segment, but activity in the 1.3 million and above region is slowing.

As recently noted by Tracy Sichterman, Broker/Owner of Berkeley Hills Realty, this week, there were some “surprising sleepers” in Berkeley that did not hear offers as scheduled. Values can be found in the hills as you move away from one current value driver: walkability.

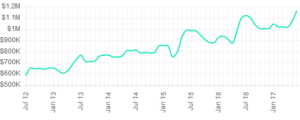

Berkeley:

According to Trulia, the median sales price for single-family homes in Berkeley for March 8th through June 7th was $1,140,500, based on 122 home sales. Berkeley market trends indicate an increase of $40,500 (4%) in median home sales over the past year.

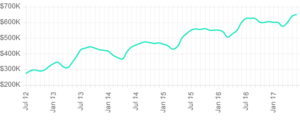

Oakland:

The median sales price for homes in Oakland for March 8th to June 7th was $650,000 based on 650 home sales, an increase of $50,000 (8%) in median home sales over the past year.

Let’s look at the surrounding markets in the East Bay:

El Cerrito:

Altos Research states that the median price for homes in this city was $833,000 and shows that prices are starting to fall from their high at the end of May.

Albany:

The median price for this quaint town is $980,113 with a bump up in inventory in the past few weeks.

San Leandro:

The median price for a single family home is $609, 674 and this market had a sizable price spike in early May and has dropped over the past five weeks.

Alameda:

The median price for a single family home is currently $988,544 with an upward trend towards price appreciation and days on the market is falling.

We should see by July how the overall spring market performed as homes under contract now will close escrow within the next two weeks. The overall climate of the East Bay housing market continues to be one of low inventory and high demand. To note, the California Association of Realtors released their spring market report showing an overall softening of the statewide housing market in April. Will it show itself in the East Bay market? We will report out the first week in July or please call our office to discuss specific market trends in the area/neighborhood you are looking in, as all markets are hyper-local in the East Bay.

As financial markets had anticipated, the policymaking Federal Open Market Committee increased its benchmark target a quarter point this week. The new range will be 1 percent to 1.25 percent for a rate that currently is 0.91 percent.

The level impacts most adjustable-rate and revolving debt like credit cards and home equity loans. The prime rate that banks use as a baseline for interest rates usually rises immediately after the Fed makes a move. They are anticipating more rate hikes this year and into next providing another push for potential homebuyers to enter the market.

Comments